16-year-old Arnav Maheshwari explores how BRICS+ is challenging the traditional global economic order

2024 BRICS summit in Russia: Iranian president Masoud Pezeshkian (left) and Egyptian president Abdel Fattah el-Sisi.

Picture by: ZUMA Press, Inc. | Alamy

Article link copied.

April 25, 2025

Breaking the dollar’s grip: How BRICS+ is reshaping global power dynamics

The global economic landscape is seeing dramatic change as the BRICS coalition (Brazil, Russia, India, China and South Africa) went on an expansion spree last year to include new members Ethiopia, Egypt, Indonesia, Iran and the United Arab Emirates. Saudi Arabia is still deciding whether or not to join.

The new bloc brings in a huge demographic weight with 3.25 billion people, over 40% of the world’s total population. The majority comes from China and India, whose combined populations exceed 2.8 billion, further solidifying BRICS+ as a heavyweight on the global stage.

These countries are working together to reduce their reliance on the US dollar in transnational trade, arguing that the dollar gives the White House disproportionate control over international finance. This is known as the de-dollarisation movement.

By promoting the use of local currencies instead of the dollar, BRICS+ hopes to strengthen their economies and lessen the impact of aggressive U.S. trade actions–like Trump’s sweeping 2025 ‘Liberation Day’ tariffs, which threaten to disrupt global commerce and deepen geopolitical rifts. These tariffs, aimed at insulating the United States’ dollar have caused

Harbingers’ Weekly Brief

With this growth, BRICS+ has positioned itself to represent 42% of central bank foreign exchange reserves – an important development in the ongoing global de-dollarisation movement, although it’s still a long way from dethroning the dominance of the US dollar.

Accordingto Paulo Nogueira Batista Jr., former vice president of the New Development Bank: “The aggressive use of the dollar for geopolitical goals has pushed BRICS nations to consider alternatives, as overreliance on one currency leaves economies vulnerable to external pressures.”

On the other hand, Isobel Coleman of the Council on Foreign Relations saidthat challenges come from inside: “The diverse political systems and poorly integrated economies within BRICS could undermine efforts towards a unified de-dollarization strategy.”

Origins of BRICS

The term “BRIC”, coined by economist Jim O’Neill in 2001, identified the four key emerging economies (Brazil, Russia, India, China) poised to reshape global finance. However, it wasn’t until 2009 that the countries established it as a formal economic bloc, adding South Africa in 2010.

The driving force for its creation was the need to provide a counterweight to Western economic hegemony, projected by institutions such as the International Monetary Fund (IMF) and the World Bank, perceived by many developing nations as disproportionately serving the interests of North America and Europe.

The push towards de-dollarisation gained momentum after the 2008 financial crisis, which exposed vulnerabilities in the dollar-dominated global economy. However, geopolitical tensions further escalated, culminating in the US imposing sanctions on Russia in 2014 following its annexation of Crimea, reinforcing apprehensions of overdependence on the US dollar.

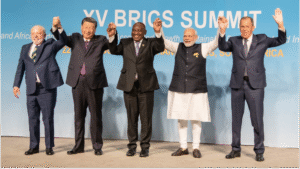

2023 BRICS summit in South Africa, from left: Brazilian president Luiz Inácio Lula da Silva, Chinese president Xi Jinping, South African president Cyril Ramaphosa, Indian prime minister Narendra Modi and Russian foreign minister Sergey Lavrov.

Picture by: 15th BRICS Summit | Flickr

The sanctions increased bilateral trade between Russia and China using yuans and rubles instead of dollars as they cited the risks of “economic weaponisation” by the US. Additionally, BRICS managed to establish the New Development Bank (NDB) in 2015 as a means of supporting financial infrastructure in emerging economies without the conditionalities imposed by Western-led institutions.

Among the most ambitious ideas discussed at the 2024 BRICS Summit in Kazan (Russia) was the introduction of a new transnational currency. Named the “unit”, this currency would be backed by gold, distinguishing it from fiat currencies, which derive their value from government backing rather than physical commodities.

Proponents argue that a gold-backed currency could provide great economic stability, cut reliance on the US dollar, and shield member economies from inflationary pressures linked to Western monetary policy.

As of February 2025, the Trump administration has threatened 100% tariffs on BRICS members trading in non-dollar denominations. These threats were acted upon, however at a lower level – Trump vollied 26% reciprocal tariffs on India and a whopping 104% on China. The European Union, a long-standing ally of the United States, has lodged concerns regarding mounting economic tensions that could derail global trade and economic stability.

Some European countries are sympathetic to Washington’s frustration, but France and Germany support the judicious path: a balanced approach to prevent full-blown economic rupture. The immediate concern for France and Germany lies in the potential impact of Trump’s trade policies on EU exports. So, is 2025 the year that changes it all, or is a major standoff inevitable?

BRICS+ vs the G7

BRICS+ and the G7 (US, UK, France, Germany, Japan, Canada and Italy) represent two significant coalitions in the global economic landscape. While the G7 encompasses most of the highly developed economies around the world, BRICS+ constitutes major emerging markets with fast-increasing growth trajectories.

In 2025, the G7’s GDP is projected to reach $45.9tn, about 43% of the global economy, while BRICS+ accounts for over $30.8tn, roughly 29%. Although the G7 leads still in terms of output, BRICS+ are steadily gaining.

While the G7 bases its global influence on long-standing alliances, military power and control over key international institutions such as the IMF and the World Bank, BRICS+ counters with vast geopolitical reach and dominance in natural resources spanning Asia, Africa, the Middle East and Latin America, giving it broad diplomatic reach and the ability to influence emerging markets.

BRICS+ countries control more than 50%of the world’s oil production through Gulf nations Saudi Arabia and Iran.

This resource dominance strengthens its bargaining power in global trade and energy security, where G7 nations are often dependent on imports from Latin America and the Middle East.

For smaller, developing economies, BRICS+ offers an alternative to Western-led financial institutions, providing funding without the stringent conditions often imposed by the IMF – though this overlooks China’s exploitation of “debt trap diplomacy” via its Belt and Road Initiative, a global project that finances major infrastructure projects in developing nations, typically in exchange for long-term political or economic influence.

Navigating internal divides

BRICS+ projects unity, but there are significant challenges to its cohesion. The coalition’s diversity, usually regarded as its strength, is actually its most significant weakness. Conflicting geopolitical interests, divergent political and economic systems, and deep-rooted cultural and religious differences are just a few fault lines that threaten to undermine its stance.

One of the most prominent challenges within BRICS is the rivalry between India and China. While the two countries cooperate economically, they have long-standing border disputes and competing interests in Asia.

Many of the internal conflicts often make consensus difficult to achieve, even on basic matters concerning infrastructure development and regional security. India, for instance, has expressed concerns shared by other members about initiatives likely to enhance China’s strategic influence in the Indian subcontinent.

A 2024 report by the Carnegie Endowment highlights BRICS+’s recent expansion into countries such as Saudi Arabia and Iran, which may introduce potential conflicts that will make consensus on common political positions more difficult.

BRICS countries: original and new members.

Picture by: OXSFJ

The political make-up of BRICS+ is varied – between democracies, authoritarian regimes and hybrid regimes. Democracies such as Brazil, South Africa and India work with different priorities from authoritarian states, such as China and Russia. Centralised decision-making allows for rapid policy changes, but also human rights concerns, including the treatment of Uyghurs in China and allegations of war crimes committed by Russian forces in Ukraine.

This political diversity exacerbates attempts at unified economic and foreign policies, as domestic agendas may prevail over collective ones within the member nations.

The addition of Iran, (possibly) Saudi Arabia and the UAE adds to the potential of sectarian divides and religious differences. Though these countries may try to cooperate economically, their competing regional ambitions and historic religious tensions – particularly between Sunni-majority Saudi Arabia and Shia-majority Iran – could complicate BRICS+ ‘ efforts to maintain peace and cohesion in the fragile Middle East.

The expansion of BRICS marks the transformation toward a multipolar global economy in a world moving beyond Western-centric power. But this is also endangered by internal rivalries, political contradictions, and economic disparities that threaten its cohesion. While the West reacts to BRICS’s rise, the bloc’s biggest challenge may come from within.

Written by:

Economics Section Editor 2025

Georgia, United States

Born in 2009, Arnav studies in Metro Atlanta in the United States. He is passionate about economics, investing, and finance, with plans to study economics at university.

Arnav joined Harbingers’ Magazine in October 2024 as a winner of The Harbinger Prize 2024 in the Economics category, earning a place in the Essential Journalism Course. During this time, while writing about the global economy, entrepreneurship, and macroeconomics, he demonstrated outstanding writing skills and dedication to the programme. His commitment earned him the position of Economics Section Editor in March 2025.

In his free time, Arnav holds leadership roles in finance-focused organisations at state and national levels and is the founder of a SaaS startup. He hopes to use his writing and leadership skills to contribute to social entrepreneurial efforts.

Arnav speaks English and Hindi fluently, with working proficiency in Spanish.

Edited by:

🌍 Join the World's Youngest Newsroom—Create a Free Account

Sign up to save your favourite articles, get personalised recommendations, and stay informed about stories that Gen Z worldwide actually care about. Plus, subscribe to our newsletter for the latest stories delivered straight to your inbox. 📲

© 2025 The Oxford School for the Future of Journalism